Vision

Luxem’s vision is to collaborate with and align the interests of its investors and portfolio companies. Find out what that means for you.

Structure

The direct investment pipeline and structure employed by Luxem offers them the ability to provide the best investment opportunity for every client.

Partnership

Luxem has many corporate partners and offices located throughout the world. This puts them in the best position to help all types of companies.

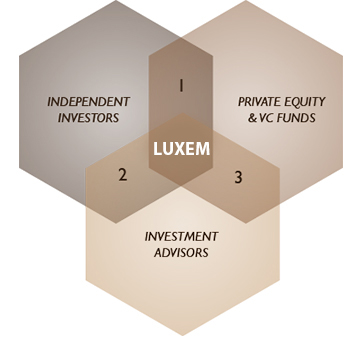

LUXEM’S POSITIONING

________

Capturing the most attractive characteristics of traditional direct investment:

+ LUXEM’s strategic positioning allows for broad portfolio diversification

+ LUXEM’s co-investment model ensures a high level of specialization and best-in-class execution

= This combination leads to higher risk-adjusted returns

1. ALIGNMENT OF INTEREST

______

Founded by private investors, a proprietary capital approach to investing is strongly anchored across the firm

2. BROAD EXPOSURE

______

Our geographic reach and broad network of investment partners provides access to a wide range of opportunities

3. SPECIALIZATION

______

With ten years of operating experience, LUXEM has gained substantial experience in structuring successful direct investments

INVESTMENT STRATEGIES

________

LUXEM offers the possibility to invest in the different stages of companies business cycle, allowing for specialized analysis and execution.

Angel

Through its Angel strategy vehicles, LUXEM invests in technology-enabled companies operating in the consumer goods, services and technology-related sectors. We seek companies with founders of exceptional profile, aggressively disrupting large and untapped market opportunities. Active investment geographies include the US, EU and the Middle East.

Growth

Within the growth stage of private companies, LUXEM focuses on sourcing direct opportunities in the consumer goods, services, technology, financial (excluding real estate) and basic materials sectors. We work directly with founders and management teams to structure expansion capital financing rounds, often times actively enlisting other value added co-investors to participate alongside our capital.

Buyout

Within the Buyout segment of private equity, LUXEM chooses to participate in opportunities led by reputable institutional sponsors. The team sources and evaluates opportunities across the broad spectrum of economic sectors and geographies. The company seeks to invest only with the leading buyout firms (in respect to historical financial performance) as well those sponsors that have demonstrated sector and market specialization.

Secondary

Through its Secondary Investment vehicles, LUXEM sources and acquires limited partnership interests in private equity funds from motivated sellers through niche channels of the broad secondary market. The company’s focus remains on acquiring interests in top quartile funds which are mostly funded and are trading at attractive discounts.

Special Situations

Special Situations are best defined as opportunistic transactions that do not qualify into LUXEM’s existing private equity strategies’ mandate. LUXEM may get access to such unique opportunities through its vast network of partners or actively seek exposure to such situations based on a specific request from investors. Recent examples include a pre-IPO opportunity and a the co-management of a frontier market fund.

Latest News

CONTACT US

UK

LUXEM WEALTH MANAGEMENT

29th Floor

One Canada Square

Canary Wharf

London UK E14 5DY

Phone: +44 (0) 20 3287 2959

Fax: +44 (0) 20 3862 9907